Compare and Choose the Right Medicare Plan

“Partner represents Medicare Advantage HMO, PPO and PFFS organizations and stand-alone PDP prescription drug plans that are contracted with Medicare. Enrollment depends on the plan’s contract renewal. This is solicitation for Insurance.”

Speak with a licensed insurance agent.

Why Medicare Plans

Medicare is Federal Health Insurance for people 65 or plus. Medicare also covers some younger people with disabilities and people with End-Stage Renal Disease. We at NewMedicare, your one-stop shop, offer no obligation Medicare Quotes, compare plans, and may help reduce healthcare costs.

Enroll Now

NewMedicare.com helps you find a Medicare coverage option that works for you. Our licensed insurance agent can answer your questions and help you and help you find a right Medicare plan that suits your needs. Your health is important, and we are here to make sure that you’re not overpaying for it.

-

FASTAll Medicare plans are state and carrier based, so it's great to work with a licensed insurance agent who knows the plans in your area, which helps you possibly save money and make the suitable choices.

-

SECUREWe will connect you with a licensed insurance agent to assist you in locating Medicare Advantage plans and will guide you through the enrollment process with the most appropriate options.

-

EASYIt is easy to get the suitable quotes for no obligation to enroll with NewMedicare.com. All you have to do is complete the form and wait for our licensed insurance agent to contact you.

Discover Your Medicare Plan Options

By interacting with this website, you agree to all tracking, recording, and monitoring of all events.

Get the latest

Get the latest updates through our newsletter and never miss an opportunity to get the updated information related to medicare plans.

Latest from NewMedicare

Medicare’s Recovery Roadmap: Exploring Coverage for Alcohol Rehab

Millions of people in the United States struggle with alcoholism, seriously threatening public health. Recognizing the importance of treatment, Medicare, the federal health insurance program, provides coverage for various medical services. Does medicare cover alcohol rehab In this article, we will continue to explore the different aspects of Medicare coverage […]

Does Medicare Cover Adult Day Care? Unlocking the Benefits

Adult daycare facilities provide a valuable service for individuals who require assistance or supervision during the day but do not require full-time residential care. These facilities offer various services, including meals, social activities, and personal care. Does Medicare cover adult day care? A common question among older adults and their […]

Does Medicare Cover Diabetic Supplies? A Comprehensive Guide

Living with diabetes requires careful management of various aspects, including monitoring blood glucose levels and maintaining a healthy lifestyle. Diabetic supplies such as glucose monitors, test strips, insulin pumps, and other related equipment are crucial in effectively managing the condition. For individuals enrolled in Medicare, it is important to understand […]

FAQ

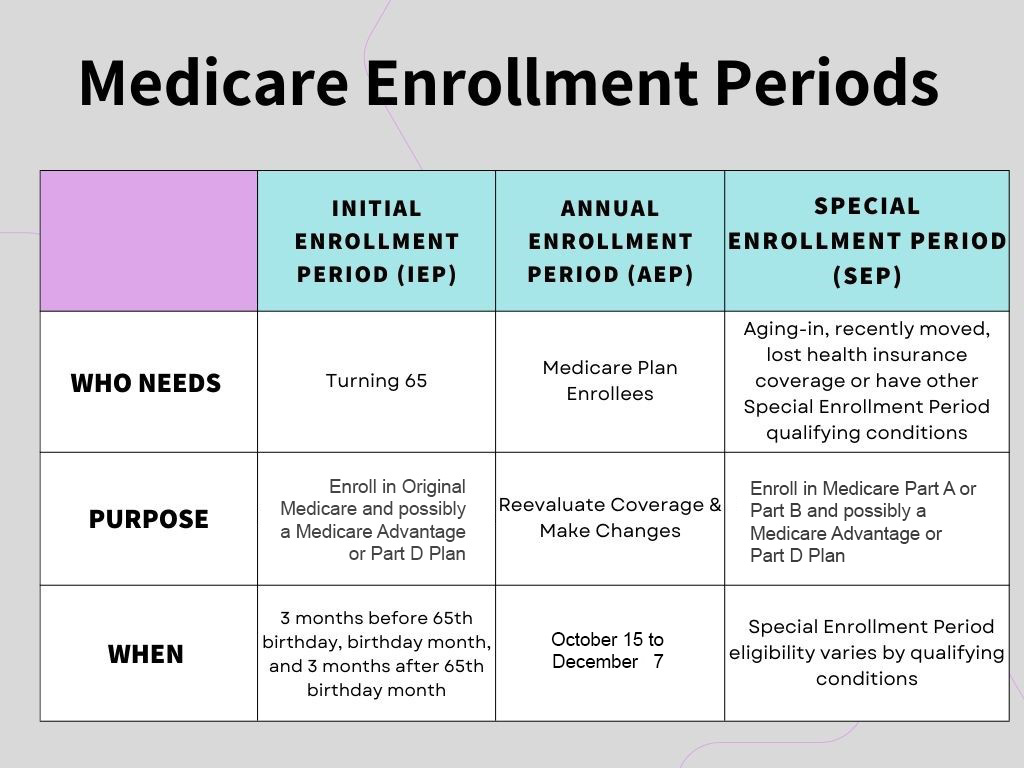

“Speak with a licensed insurance agent to review your eligibility to review and possibly enroll in a Medicare Plan during one of these enrollment periods.”